CMM 2023-12-10

Minutes of Meeting for Worship with Attention to Business

Concord (NH) Monthly Meeting of

the Religious Society of Friends

10th of Twelfth Month 2023

Eleven Friends gathered for Meeting for Worship to attend to business, in person and by Zoom. We opened with a brief period of quiet Worship. The clerk read us a quote from Howard Brinton about Quaker Meeting business process,

At its best, the Quaker method does not result in a compromise. A compromise is not likely to satisfy anyone completely. The objective of the Quaker method is to discover Truth which will satisfy everyone more fully than did any position previously held. Each and all can then say, ‘That is what I really wanted, but I did not realize it.’ To discover what we really want as compared to what at first we think we want, we must go below the surface of self-centered desires to the deeper level where the real Self resides. The deepest Self of all is that Self which we share with all others. This is the one Vine of which we all are branches [John 15:1–6], the Life of God on which our own individual lives are based. To will what God wills is, therefore, to will what we ourselves really want.

– Howard H. Brinton. Reaching decisions: the Quaker method. Wallingford Pa., Pendle Hill, 1952. (Pendle Hill Pamphlet № 65, page 18)

Minutes of Eleventh month 2023 were approved as posted on our website with the correction that we decided to make to 11.06 to make it more consistent with minute 11.03 and the reality of how things work under Federal tax code.

12.01 Facility Use Policy: At the request of the clerk of property committee, we approached the issue of the childcare expectations under our facility use policy. Some Friends present today were willing to meet to look at the issues, looking to inform the rest of our Meeting about their understanding of the current policy. Jonah S, Sara S, Juliet C and Ruth H will take up this responsibility.

12.02 Peace, Social & Earthcare Concerns: The clerk of PSECC committee gave us a verbal report about committee activities in the recent past. This included a fundraiser for AFSC-NH and a concert fundraiser for our Asylum Seekers Support Fund that they hosted with a well-known musician and storyteller that packed the Meetinghouse. Once the final numbers are known, the committee will give us a written report of how they managed the event and the amount of money it raised.

12.03 Youth Religious Education: YRE committee gave us a verbal report about their intentions to do outreach to families. The committee noted that Elanor T, a regular attender of our Meeting First Day school will be joining the committee.

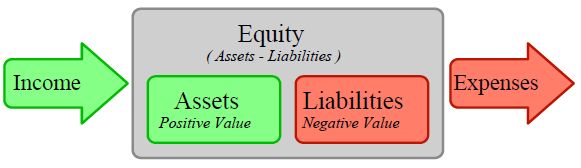

12.04 Treasurer’s Report: Finance committee reported on the current state of our interim FY2024 budget for this fiscal year. At six months of the fiscal year, we have received $17,710 income and have paid expenses of $11,230. They also presented the balance sheet update. These reports are attached as is a report about the financing of our new heating system. This focuses on the cash flow related to the costs and the short-term loans used to accomplish the work and the anticipated moneys returning to us from the Federal tax code incentives for nonprofits to get what would have been a tax credit for a for-profit business.

An updated proposal for a replacement of the above interim budget for fiscal year 2024 (6/1/2023 to 5/31/2024) was also brought along with reasoning for the major changes involved. This is attached. Friends approved this final budget as proposed with gratitude for the work of the finance committee.

| Total Income: | $17,710 | |

|---|---|---|

| Total Expenses: | $11,230 | |

| Net Income: | $6,480 |

We closed with a brief period of quiet worship, purposing to meet again on the second First Day of First month 2024.

| Submitted by, | Accepted as the Approved Record, | |

| /s/ Jennifer Smith, Recording Clerk | /s/ Richard Kleinschmidt, Presiding Co-Clerk |

| Concord Monthly Meeting Statement of Operations | 2023-06-01 – 2023-11-30 | Budget – FY 2023-24 | Budget Remaining | % of Budget Raised |

|---|---|---|---|---|

| Income | ||||

| Contributions | $15,201 | $27,400 | $12,199 | 55% |

| Interest Income | $69 | $810 | $741 | 9% |

| Rental Income – Child Care | $2,000 | $0 | ($2,000) | 100% |

| Rental Income – Others | $440 | $900 | $460 | 49% |

| Solar Roof Lease | $0 | $240 | $0 | 0% |

| Total Income | $17,710 | $29,350 | $11,400 | 60% |

| Expenses | % of Budget Spent | |||

| Program | ||||

| Finance Committee | $0 | $30 | $30 | 0% |

| Hospitality | $51 | $100 | $49 | 51% |

| Library | $0 | $140 | $140 | 0% |

| Ministry & Counsel | $0 | $400 | $400 | 0% |

| Outreach Committee | $0 | $175 | $175 | 0% |

| Peace, Social & Earthcare Concerns | $0 | $150 | $150 | 0% |

| Right Relations | $0 | $400 | $400 | 0% |

| Website Expense | $0 | $1,000 | $1,000 | 0% |

| Youth & Religious Education | $60 | $300 | $240 | 20% |

| Total Program | $110 | $2,695 | $2,585 | 4% |

| Property | ||||

| Data Usage | $595 | $960 | $365 | 62% |

| Debt Service | $1,903 | $3,805 | $1,902 | 50% |

| Depreciation | $1,905 | $3,810 | $1,905 | 50% |

| Donation in Lieu of Taxes | $0 | $500 | $500 | 0% |

| Electricity | $500 | $1,000 | $500 | 50% |

| Furnishings | $0 | $0 | $0 | 0% |

| Grounds | $0 | $100 | $100 | 0% |

| Insurance | $1,490 | $2,890 | $1,400 | 52% |

| Maintenance | $379 | $1,180 | $801 | 32% |

| Snow Removal | $0 | $1,600 | $1,600 | 0% |

| Supplies - Bldg. & Maintenance | $56 | $250 | $194 | 22% |

| Wood Pellets | $215 | $1,200 | $985 | 18% |

| Total Property | $7,042 | $17,295 | $10,253 | 41% |

| Support | ||||

| AFSC | $824 | $1,640 | $816 | 50% |

| Dover Quarterly Meeting | $0 | $10 | $10 | 0% |

| FCNL | $0 | $157 | $157 | 0% |

| Friends Camp | $0 | $314 | $314 | 0% |

| FWCC | $0 | $68 | $68 | 0% |

| Interfaith Council | $0 | $50 | $50 | 0% |

| NEYM - Equalization Fund | $0 | $314 | $314 | 0% |

| NEYM - General Fund | $3,246 | $6,491 | $3,245 | 50% |

| NH Council of Churches | $0 | $75 | $75 | 0% |

| Woolman Hill | $0 | $241 | $241 | 0% |

| Total Support | $4,070 | $9,360 | $5,290 | 43% |

| Landscaping | $8 | $0 | ($8) | 100% |

| Total Expense | $11,230 | $29,350 | $18,120 | 43% |

| Net Income | $6,480 |

NB. The Income & Expenses Sheet was created with two decimal points, which were removed for readability, the cents being unimportant to the overall understanding. This can have the effect of throwing off any given sum by a dollar due to compounded rounding. — Prepared by Greg Heath and Chris Haigh.

| Concord Monthly Meeting Balance Sheet | 11th Month 30, 2023 | ||

|---|---|---|---|

| ASSETS | |||

| Current Assets | |||

| Checking/Savings | |||

| Checking MCSB | $18,820 | ||

| Money Market MCSB | $114 | ||

| Savings Granite State Cr Union | $10 | ||

| Total Checking/Savings | $18,944 | ||

| Accounts Receivable | |||

| Accounts Receivable | $0 | ||

| Total Accounts Receivable | $0 | ||

| Other Current Assets | |||

| Prepaid Electricity | $4,502 | ||

| Prepaid Insurance | $248 | ||

| Total Other Current Assets | $4,751 | ||

| Total Current Assets | $23,695 | ||

| Fixed Assets | |||

| Building/Furnishings/Fixtures | $513,629 | ||

| Equipment | $0 | ||

| Less Accumulated Depreciation | ($34,978) | ||

| Land (including new lot) | $144,400 | ||

| Total Fixed Assets | $623,051 | ||

| Other Assets | |||

| Granite State Credit Union CD | $3,102 | ||

| Total NH Community Loan Fund | $24,869 | ||

| Total Other Assets | $27,971 | ||

| TOTAL ASSETS | $674,717 | ||

| LIABILITIES & EQUITY | |||

| Liabilities | |||

| Current Liabilities | |||

| Loan - Heating - Fire Safety | $14,000 | ||

| Total Current Liabilities | $14,000 | ||

| Long-term Liabilities | |||

| Mortgage Loan | $6,340 | ||

| Total Long-term Liabilities | $6,340 | ||

| Total Liabilities | $20,340 | ||

| Equity | |||

| General Fund Balance | |||

| Fire Safety Improvements | $30,035 | ||

| Land & Building Fund - Other | $610,855 | ||

| General Fund Balance – Other | $561 | ||

| Total General Fund Balance | $641,451 | ||

| Temp. Restricted Net Assets | |||

| Donor Restricted Funds | |||

| Asylum Seekers Support Fund (ASSF) | $1,192 | ||

| Kakamega Family Support Fund | $1,818 | ||

| Mindful Mortality | $975 | ||

| Social Justice Fund | $303 | ||

| Solar Grant Fund | $1,209 | ||

| Total Donor Restricted Funds | $5,497 | ||

| Meeting Temp. Restricted Funds | |||

| Friendly Assistance Fund | $950 | ||

| Total Meeting Temp. Restricted Funds | $950 | ||

| Total Temp. Restricted Net Assets | $6,447 | ||

| Net Income | $6,480 | ||

| Total Equity | $654,377 | ||

| TOTAL LIABILITIES & EQUITY | $674,717 |

| Concord Monthly Meeting Budget Comparisons & Proposal | 2023 Continuing Budget (same as last FY Budget) | Last Fiscal Year Actuals (2022-06-01 – 2023-05-31) | FY 2024 Proposed Budget | Changes From Previous FY Budget | Explanations of Proposed Amounts |

|---|---|---|---|---|---|

| Income | |||||

| Contributions | $27,400 | $27,591 | $27,400 | $0 | same as FY 23 Budget |

| Interest Income | $810 | $930 | $1,090 | $280 | Current NHCLF loans with $160 more from current bank CD |

| Rental Income - Child Care | $0 | $0 | $5,400 | $5,400 | Based on lease & anticipated full enrollment by Feb 1 |

| Rental Income - Other | $900 | $1,729 | $1,200 | $300 | An unknown variable |

| Solar Roof Lease | $240 | $240 | $240 | $0 | Fixed by agreement |

| Total Income | $23,350 | $30,490 | $35,330 | $5,980 | |

| Expenses | |||||

| Program | |||||

| Finance Committee | $30 | $0 | $100 | $70 | Increased due to anticipated expenses |

| Hospitality | $100 | $65 | $100 | $0 | same as FY 23 Budget |

| Library | $140 | $26 | $140 | $0 | same as FY 23 Budget |

| Ministry & Counsel | $400 | $0 | $400 | $0 | same as FY 23 Budget |

| Outreach | $175 | $190 | $175 | $0 | same as FY 23 Budget |

| Peace, Social & Earthcare Concerns | $150 | $0 | $150 | $0 | same as FY 23 Budget |

| Right Relationships | $400 | $0 | $400 | $0 | same as FY 23 Budget |

| Website Expenses | $1,000 | $148 | $1,000 | $0 | same as FY 23 Budget; unsure if needed |

| Youth & Religious Education | $300 | $176 | $300 | $0 | same as FY 23 Budget |

| Total Program | $2,695 | $604 | $2,765 | $2,695 | |

| Property | |||||

| Data Usage | $960 | $1,008 | $1,200 | $240 | Comcast increased contract |

| Debt Service (Prin. & Int.) | $3,805 | $3,805 | $3,805 | $0 | Quarterly Payments end January 2025 |

| Short-term Borrowing Interest | $0 | $0 | $500 | $500 | Less than originally projected due to principal payments made |

| Depreciation | $3,810 | $3,810 | $3,810 | $0 | Same as last year including enough for new heating system |

| Donation in Lieu of Taxes | $500 | $500 | $0 | ($500) | Eliminate due to Pathfinders Child Care and Oxbow Solar tax payments |

| Electricity | $1,000 | $999 | $1,000 | $1000 | same as FY 23 Budget |

| Updated Agreement with Oxbow Solar | $0 | $999 | $1,000 | $0 | A variable TBD but best guess |

| Grounds | $1,000 | $78 | $1,000 | $0 | May not be needed if funded by Legacy Grant from NEYM |

| Insurance | $2,890 | $2,884 | $3,072 | $182 | Based on Church Mutual new premium commencing January 2024 |

| Maintenance | $1,180 | $1,276 | $1,740 | $560 | For possible installing of acoustic panels in Worship Room |

| Snow Removal | $1,600 | $1,460 | $1,600 | $0 | same as FY 23 Budget |

| Supplies - Bldg. & Maintenance | $250 | $150 | $250 | $0 | same as FY 23 Budget |

| Wood Pellets | $1,200 | $1,319 | $0 | ($1,200) | No more need |

| Total Property | $17,295 | $17,289 | $18,477 | $1,182 | |

| Support | |||||

| AFSC | $1,640 | $1,640 | $1,889 | $249 | 3% increase for organizations with payroll |

| Dover Quarterly Meeting | $10 | $10 | $10 | $0 | same as FY 23 Budget |

| FCNL | $157 | $157 | $162 | $5 | 3% increase for organizations with payroll |

| Friends Camp | $314 | $314 | $323 | $9 | 3% increase for organizations with payroll |

| FWCC | $68 | $68 | $227 | $68 | FY 23 Budget + NEYM calculated share |

| Interfaith Council | $50 | $50 | $50 | $0 | Based on membership assessment |

| NEYM - Equalization Fund | $314 | $314 | $361 | $47 | 15% increase |

| NEYM - General Fund | $6,491 | $6,491 | $7,465 | $974 | 15% increase |

| Friends General Conference (FGC) | $0 | $0 | $159 | $159 | NEYM calculated share |

| Friends United Meeting (FUM) | $0 | $0 | $159 | $159 | NEYM calculated share |

| NH Council of Churches | $75 | $75 | $75 | $0 | Based on membership assessment |

| Woolman Hill | $241 | $241 | $248 | $7 | 3% increase for organizations with payroll |

| Total Support | $9,360 | $9,360 | $11,128 | $1,768 | |

| Total Expense | $29,350 | $27,253 | $32,369 | $3,019 | |

| Net Income | $0 | $3,237 | $2,961 | $2,961 |

| Source of Funding | Actuals |

|---|---|

| Capital Campaign | |

| Capital Campaign – Individuals | 18,485 |

| Capital Campaign – Grants | 11,500 |

| Total Capital Campaign | 29,985 |

| Other Source of Funds | |

| Federal Subsidy (30% of geothermal) ** | 15,383 |

| Sale of Boiler Items | 689 |

| Replacement Reserve Savings | 20,000 |

| Total Other Source of Funds | 36,072 |

| Total Source of Funds | 66,057 |

| Funds Expended (includes $1000 for landscaping materials) | 68,724 |

| Gain/(Loss ) | (2,667) |