Solar Array History

Concord Friends Meeting’s Solar Array – A History

And Background for Decision Making in 2024

April 2024

Approved by the Solar Committee: Chris Haigh, Greg Heath, Ruth Heath, Jonah Sutton-Morse, and Dave Woolpert with contributions from Oxbow Solar LLC: Jennifer Smith

Introduction.

The Meeting has been approached by Oxbow Solar, LLC (owned by Jennifer Smith) with a request that it purchase the solar array that Oxbow Solar LLC owns and has installed on the Meeting’s roof. The Solar Committee has been looking into this possibility and has concluded that the Meeting would benefit from a written history of our solar project. We refer to it as “our” project because Oxbow Solar was recruited as an investor by the Meeting to make this happen.

In 2016 we began plans to solarize the meetinghouse. Given the regulatory environment at the time we came up with a wonderfully creative way to solve funding challenges and attain goals that extended well beyond meeting our electricity needs through solar power. This is the story of how that all came to fruition, and how we have arrived at this decision point in 2024. The story begins long before 2016.

The New Meetinghouse. Solar in Our Bones.

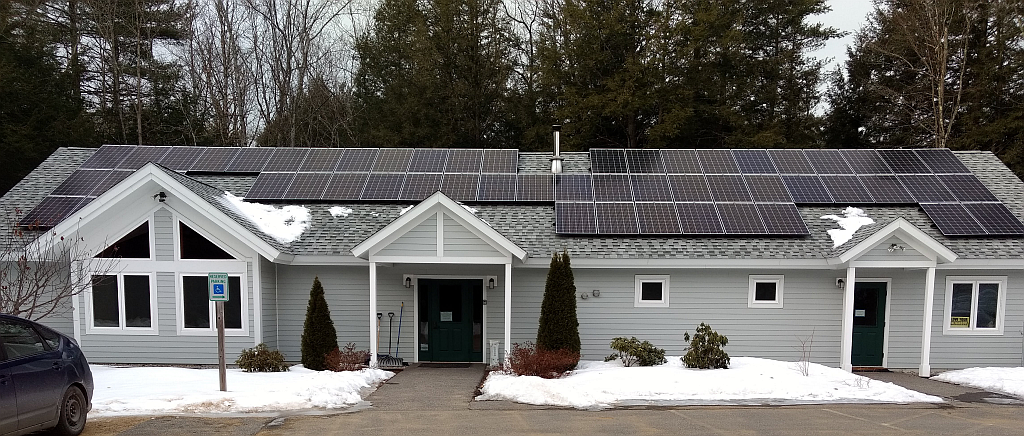

For many years Concord Meeting had a clear sense that it was better off without the burden of owning land and keeping up a building. Gradually that sense began to waver and by early in the new century a new clarity was emerging. Once it became clear that we intended to build a permanent home for the Meeting, we knew that it had to be highly energy efficient. Minimizing the carbon footprint drove our planning as much as, or more than, any other factor. Don Booth, one of our elder members, was a residential housing passive solar pioneer through the 1970s and 1980s, and he ensured our roof pitch and southern orientation were optimal for solar panels to the extent permitted by our building lot.

In 2010 we bid a truly fond farewell to Merrimack Valley Daycare Center, our home for more than forty years, and moved into our new meetinghouse on Oxbow Pond Rd. in Canterbury. We brought the thrill of new owners with us. But even as we enjoyed our new space, our keen sense of the gravity of the climate crisis continued to propel us toward becoming a net zero carbon user.

We Get Serious and Think Big.

Rapid changes were underway in the solar industry during this period as prices dropped, installers popped up, and governmental incentives and regulations were evolving in beneficial ways. By 2015, the time appeared ripe to move in some way on this as members kept looking into and discussing the possibilities. In February of 2016, the Meeting formed a Solar Committee to take over preliminary investigations that both the Budget (so named at the time, now Finance) and Property Committees were undertaking. The new Solar Committee (Jon Hall, Ruth and Greg Heath and Jennifer Smith) would also support the work Jennifer had begun to attain grant support from New England Yearly Meeting’s Legacy Fund which had a March 1st 2016 application deadline. Just in time, there was a specially called Meeting for Business to give final approval for the grant application on February 28th. The proposal was successful with an award of $6,000 made in June. We were truly encouraged.

An important part of the work was to understand the state’s electric utility regulations around solar energy. Especially interesting were rules that allowed groups of people to join together to generate solar power at one location for the entire group, a concept known as group net metering. Knowing that our large roof would provide much more energy than we would use, we thought we could form such a group with participants who could not go solar themselves. Replacing the coal fired Bow electrical station just a few miles downriver with small renewable energy projects was always on our minds.

One big hurdle was the financing of such a large project. As a church that does not pay taxes we were not able to take advantage of the tax incentives that were available to for-profit businesses at that time. We thought that if we could find a way to take advantage of these incentives we could become a demonstration project for other churches, showing them a way to go solar, multiplying the positive impact of our project. Those incentives were critical to making the project affordable for us.

Having heard of businesses being established to own solar arrays for churches and other nonprofit organizations, we took a deep dive into this possibility, soon discovering a complex array of legal issues to overcome. We could tell these issues were not ones to take to a general practice attorney. Our advisors would need to be well versed in a variety of areas of the law and taxation including contracts, nonprofits, corporate taxation and rapidly evolving energy law. In June, determined and undeterred by the apparent complexity of the project, we used New England Yearly Meeting’s grant to help us retain professional advice.

The Legal Team.

One of the major firms in Concord was happy to meet with us. Our enthusiasm quickly turned to dismay and discouragement when this meeting with multiple attorneys devolved into basic questions from them that demonstrated they had not even read the brief synopsis of needs and questions submitted in advance. The clock ticked (ka-ching, ka-ching) and $1,500 later we left with little to show for it other than a sense of defeat. We had hired an accountant to provide a financial analysis that was helpful, but not cheap. Our $6,000 grant was going to be gone in a flash, and we had to consider that perhaps this project was beyond our reach.

Rob Howard, an attorney who had helped us with our real estate needs when we built the meetinghouse, suggested we contact another firm that might approach our needs with greater earnestness. He recommended Rath, Young, and Pignatelli. Our initial consult with their team (Paul Burkett, a contract specialist, and Chuck Willing, an energy specialist) felt like a good fit and they seemed to see all the major issues right off the bat. Then, necessarily, we had to talk cost. We told them about our experience with the other law firm and our remaining grant funds. They listened politely and said they would get back to us. We left this meeting feeling much better.

A few days later we heard their plan. In our project they saw a community benefit worthy of support, and they would have the opportunity to fully explore the evolving New Hampshire legal landscape as it pertained to group net metering. Though not a small project, they would charge us a flat fee and the rest of the work would be pro bono. Their fee would be $2,500. We were overjoyed at this key pivot point in the project. With this team in place the work could move into high gear. Eventually they would donate a little more than $20,000 in legal services. By the end of 2016 the Meeting had the overall plan in place and approved the implementation of its various elements.

Element 1. A Company Formed.

Oxbow Solar, LLC was formed by Jennifer Smith to own the system so that it could take advantage of benefits intended for businesses. For example, there were small business grants for energy projects that amounted to one third of the cost of the installed equipment. In addition, the value of the system could be depreciated, or written off, resulting in losses that the company owner could use to reduce her personal income and thereby her taxes. An important aspect of her company was that it was a friendly investor, but more on that later.

Element 2. Buying Our Electricity in Advance.

The investor would take over our electric interface with Unitil, our utility, in essence becoming the Meeting’s electric supplier. The Meeting had been spending about $1000 dollars a year for its electricity. What if we did a pre-buy of our electricity for ten years? The advantage for the Meeting was to lock in the price. The advantage for the investor was obtaining the capital for investment. In the end, we did just that, paying the investor $10,000 in advance. For the benefit of receiving this capital, the investor assumed risk. Ten years is a long time. What if electric rates increased steeply? What if the Meeting started to use a lot more electricity?

Element 3. Gathering Our Group Net Meter Participants, With Disappointment and Success

This element turned out to be time consuming and surprising.

In a group net metering project each member’s annual electric usage is summed into one total. The array is sized to provide electricity equivalent to that sum. We would need one or two nonprofits or churches to populate our group.

We approached two mainline protestant churches in Concord who seemed predisposed to support renewable energy and made presentations to their finance committees. Although they invested a good deal of energy in considering the project, in the end they declined to join. This was despite the fact that our plan required no investment from them and would generate income for the churches after ten years of membership and would continue for 15 more years. One of our major goals (to be a trail blazer and example for other houses of worship) was stuck in the mud.

As we watched the decisions unfold from these church committees, we had to admit they made sense. Our plan had an element of “too good to be true”. Even with our testimony of integrity they may well have been, should have been, on guard. The sad conclusion was that most institutions are naturally conservative. They have committees answerable to governing bodies with a fiduciary responsibility to donors. They had to exercise due diligence. If we had been presented with a thirteen page contract (the Group Net Meter Agreement), we would probably want to hire a lawyer to advise us. So hundreds of unbudgeted dollars later one would then have to explain this complex agreement with convincing clarity to anyone and everyone involved. A tall order.

So with two rejections in hand we had to face the likelihood that more time spent would turn up similar results. Meanwhile, we were up against deadlines and the clock was ticking. Rate changes were about to go into effect that would have allowed a lower return on net meter solar generation sales to the utilities, throwing off our projections for system profitability. And the window for getting guaranteed rebates from the NH renewable energy fund was about to close as it appeared that fund was about to run out of money. It was time to change course.

For good or for ill, private individuals will often make decisions in a snap with no committee consultations required. Residential homeowners became our targets for group membership because they could make decisions quickly. With no investment required we quickly found three households who would join our group, two being members of the Meeting, the Barkers and the Spencers. The third was another family in Canterbury, Steve and Patrice Rasche. The third was another family in Canterbury, Steve and Patrice Rasche. All three families were eager to go solar having a variety of motivations. Either they had extreme shading, unsuitable lot orientations, or simply a desire to help this project move forward.

Element 4. Financial Modeling

Looking at the numbers made our heads spin. Early on we had to start on financial models that would show the income, expenses and net for several imagined scenarios. These would help us project when the project would break even. By the end of 2016 the Meeting was making commitments to go ahead, operating on evolving information and faith. The Solar Committee had created many, many spreadsheets, each based on new information as acquired. This work continued well into 2017. Some of those workbooks had six different worksheets with linked data. We could change one variable and the consequences would ripple through the 25 years of the life of the contracts. Different worksheets or tabs projected the investor taxable income and expense budget, cash flow for the investor, and their return on investment. This was compared to the Meeting’s option to go solar alone, just meeting our own needs, and what that would cost and save over time. We considered the cost of lost interest on the $10,000 prepayment for electricity. In the end the modeling told us our plan to cover the roof with panels and pioneer the group net metering would work. While scaling back to cover just our own needs was a fall-back position, our analysis told us we could go big.

Element 5. Legal Documents.

There are three contracts that establish the relationships in this scheme: a lease of the meetinghouse roof to the investor, the Power Purchase Agreement, and the Group Net Metering Agreement. Before describing the principal terms of each (skipping over many minor or standard provisions), it’s important for the reader to understand a primary intention behind these documents.

Aside from the usual kinds of protections and clarity for the parties, these contracts define the arm’s length relationship between Oxbow Solar and the Meeting. This is a fundamental protection for each entity. If the Meeting took away any risk to Oxbow Solar’s investment by guaranteeing a certain return on investment or through any other action, the two entities could be deemed by the I.R.S. to be not separate, but one de facto entity. That could seriously jeopardize the Meeting’s tax exempt status, and Oxbow Solar, part of a church, could be viewed to have fraudulently accepted federal funds for small businesses. It’s fine for the two entities to have a friendly relationship, but, quite obviously, not fine to conspire in a fraud.

- The Roof Lease. This is the simplest contract. The Meeting leases the roof for the purpose of the solar array at a rate of $240 per year for the life of the contract, 25 years. Certainly, the amount is nominal. One could view it as favorable to Oxbow Solar, but the attorneys advised this was not a concern.

- The Power Purchase Agreement.

- The PPA establishes the Meeting’s pre-purchase of all the energy it might require for 10 years for a flat cost of $10,000.

- After 10 years the Meeting would then be required to pay for its electricity at the retail rate Unitil charges Oxbow Solar.

- The Meeting may unilaterally purchase the system from Oxbow Solar at its fair market value during a defined window after year 6, that is to say now, or at any time by mutual agreement,

- Such a purchase was envisioned in order to reduce our electric costs after year 10.

- The Group Net Meter Agreement.

- This contract spells out the way in which members (the three households mentioned earlier) benefit from the system and their responsibilities and the host’s.

- There was no required investment.

- The members would need to forego their own solar development (something they had already decided upon).

- Funds flow from Unitil to the system owner based on the utility’s purchase of electricity over and above what was used by the meetinghouse. Some of those funds flow out in quarterly payments to the members from year 11 through year 25. The cost of system maintenance and administration would first be deducted from these distributions to members.

- It would be possible to terminate the agreement if all parties agree. However, this would trigger a substantial drop in Unitil reimbursements to the wholesale rate (for extra production beyond what the building used) because the host would no longer qualify for the much higher retail rate.

- If it is not yet clear to the reader, we should note the Meeting’s sudden increase in electric usage due to the heat pump will diminish amounts that would otherwise have been paid out to members, but no promises were made to the members as to amounts they should expect from the arrangement.

Element 6. A Friendly Investor

The final piece of the puzzle is the notion of having a friendly investor. All sorts of arrangements are made by solar companies with home and business owners. At one extreme is the Tesla model in which Tesla pays for, installs, and continues to own the solar array, charging the homeowner for electric usage at a mutually beneficial rate. On the other extreme the homeowner owns their system outright and reaps all the benefits.

There are good reasons we chose a middle path and did not hire a larger solar company such as Revision to create our group and manage it. First, they and others were just getting into that business and they had no track record to evaluate. We were among the very early group net meter projects in the state. Second, such a company would have had a need for profit far exceeding what we hoped would satisfy a friendly investor and keep the investor and the Meeting within reasonable project budgets. Nor did the Meeting have the wherewithal to purchase a system outright. We were only 5 years into our 15 year mortgage loan having tapped out our members who donated most of the meetinghouse construction cost. Fundraising and additional borrowing didn’t seem reasonable.

Another model we looked at was a Monadnock region net meter group that would benefit its friendly investor and the Monadnock Food Coop. Their model projected that after 6 years the investor would have made their desired return on investment. At that point the food coop would purchase the system and the original owner would make a gift to the coop in the same amount. Our plan, once again with no guarantees to the Meeting or our investor, would follow the general arc of this model. We should note that there were significant differences, and we were looking at a breakeven for the investor around year 10.

We shopped for a Quaker investor who would be motivated to enable this plan to go forward, who was willing to manage it, and who would be happy with about a 5% annual return on investment. Managing it would mean establishing a company, keeping the books, reporting to the utility regularly, applying for grants and meeting all their conditions, filing taxes, accepting risk, and dealing with maintenance. At the time interest rates were pretty low, so a 5% return felt like much more than it does in 2024. Nonetheless such an investor, disinterested in the Meeting, might have expected an annual return of 15% or more on their investment.

The original thought was that the Meeting would acquire the system sometime before 10 years of operation when we would need to begin monthly payments for electricity again. One Meeting member planned to take this on and backed out when, at the last moment, a concern about the terms of a federal grant raised by the lawyers seemed to require the investor to retain ownership of the array for a substantially longer than 10 years. This was another point when the whole project could have fallen apart. Fortunately Jennifer Smith stepped in despite this concern and agreed to take on the project funding and ownership. As it would happen later, the federal funding concern was allayed.

Before leaving this topic we would like to restate explicitly, there were no prearranged or subsequently arranged verbal agreements between the Meeting and Oxbow Solar. The only agreements and obligations between the parties are the contracts referenced above.

In Conclusion. Next Steps.

At this point the Solar Committee is taking steps to get an independent fair market value of the system. Oxbow Solar is reviewing its accounting and assessing its return on investment. When the FMV is set the Committee expects to ask the Meeting to approve acquiring the solar system and will present its financing plan. As expected, the acquisition will require the Meeting to take over obligations to the net meter group.

From a financial perspective, the full extent of what the present circumstance means for the Meeting is not known presently. The Solar Committee continues to work to clarify outstanding questions and will report to the Meeting as it is able. We should point out that the Committee may ask the Meeting to take on some significant costs in order to own the solar array. There would also be offsetting income from Unitil. Further resources would become available after January of the coming year when we will make our final mortgage payment. We do not anticipate the need to ask Meeting donors to chip in further.

Thank you for bearing with us through this history. For everyone to have a clear understanding of the solar project’s inception and development will be important as we approach decision making later in the year.

See also Energy Choices: Opportunities to Make Wise Decisions for a Sustainable Future (2018 – QIF #11)